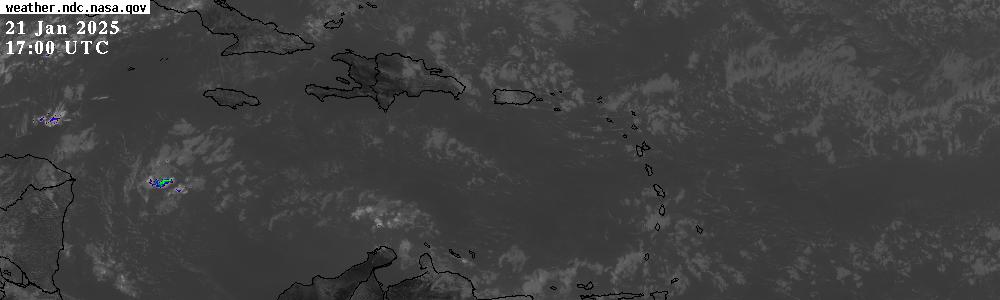

Central America is preparing for a battering by Hurricane Felix, which now a category four storm as it rages through the Caribbean.

Central America is preparing for a battering by Hurricane Felix, which now a category four storm as it rages through the Caribbean. Honduras expects to be hit Tuesday and has issued a hurricane warning for some coastal areas. With wind speeds now around 135MPH.

Felix was well above the minimum force for a category five storm. It comes just two weeks after Hurricane Dean killed 18 people in the region.

This makes Felix as well as Hurricane Dean stronger storms than any typhoons seen in the Pacific this year so far, even though Pacific typhoons are generally more frequent and powerful than Atlantic hurricanes.

Historically there have been 8 Category 5 hurricanes in the past 5 years (Isabel, Ivan, Emily, Katrina, Rita, Wilma, Dean, Felix).

This season there have been two Category 5's Dean and Felix; only three other seasons have had more than one (1960, 1961, 2005).

Felix is an awesome storm to watch. But its destructive power is something that we can do

without. Wind shear in the sector is very low and the hurricane is moving into the warmest part

of the Caribbean. Amazing drop to 64mb in just 24 hours. I have asked the NHC about this.

Though NHC thinkiing is that Felix may diminishing more in intensity when it hits the Honduran

coastline and then become a Cat 3 heading toward Belize. Will it pick back up as it enters

warmer waters?

We need to watch the track on this storm when it reaches the Bay of Campeche.

Stay tuned!

RS

![[full basin map of tropical cyclone activity]](http://www.nhc.noaa.gov/tafb_latest/refresh/danger_atl_latestBW_sm2+gif/030037123_sm.gif)

![Validate my RSS feed [Valid RSS]](valid-rss.png)