Improved Tsunami Early Warning With New Software System

Improved Tsunami Early Warning With New Software System ScienceDaily (July 14, 2008) — After completing their simulation component in the German-Indonesian Tsunami Early Warning System (GITEWS), the team for tsunami modelling of the Alfred Wegener Institute for Polar and Marine Research in the Helmholtz Association has presented the currently leading software system for tsunami events with the potential for catastrophe. It is now being integrated into the Decision Support System (DSS) of the German Aerospace Center in Oberpfaffenhofen. It is to resume its test mode in Indonesia in November.

"Within slightly more than two years, my team has developed, with the help of current software technology, the most modern and flexible simulation system for one of the most dreaded natural disasters of the world", explains Dr. Jörn Behrens, Head of the Tsunami Modelling Group of the Alfred Wegener Institute. "In contrast to other currently available Tsunami Early Warning Systems, it does not only use earthquake data for its ultra-fast situational analysis, but it combines various measurements to a robust, precise, and quick situation report."

Next to seismic data (earthquake parameters), also gauge and buoy data (wave heights), and GPS data (deformations of the earth's crust) can be incorporated into the calculations. All these data run together in the DSS, and the picture of the general situation supports decision-makers -- for example after a seaquake -- to evaluate more reliably and quicker than before, whether it poses a threat for residents of the bordering coastline in the form of rising water waves. Accordingly, warnings reach affected persons earlier than before, and it leaves more time to take disaster prevention measures.

Furthermore, simulation results from different institutes can seamlessly be integrated into the system. The team from the Alfred Wegener Institute will provide the warning system until November 2008 with already around 1500 high-resolution tsunami scenarios. The newly developed simulation system compares these scenarios with incoming real measurement data in a matter of seconds and deduces its forecast. The Indonesian partners work on the completion of the database at the same time.

Together with colleagues from the Indonesian "Institute of Technology Bandung", a connection to approximately 160.000 local tsunami scenarios they calculated is now being incorporated into the system developed at the Alfred Wegener Institute in Bremerhaven. They allow an essential expansion of the database."In regard to the interface to other programs, we adhere to open standards, which control the exchange of data in the world of computers. This way, external scenarios can seamlessly be integrated, and we can adapt the simulation model quickly to other marine areas of the world, for instance the Mediterranean Sea," says Behrens about the perspective for further early warning systems.

The Tsunami Modelling group consists of seven researchers and PhD students, among them one PhD student from Indonesia. It was established at the beginning of 2006, and has developed, next to the simulation system presented here, the simulation software TsunAWI, which is one of the bases for the computation of tsunami scenarios. The software has mastered its practical test: it computed the resulting wave heights precisely, when an earthquake of magnitude 7,9 near Bengkulu/Western Sumatra triggered a tsunami on September 13th 2007.

The aim of GITEWS is to minimize the consequences of natural disasters by means of an early warning system. Nevertheless, a natural phenomenon like the tsunami in the year 2004 cannot be prevented, and catastrophes of this kind will always cause casualties, regardless of a perfectly working alarm system. GITEWS is developed by several scientists and engineers from the Helmholtz Centre Potsdam German Research Center for Geosciences (GFZ), the Alfred Wegener Institute for Polar and Marine Research in the Helmholtz Association (AWI), the German Aerospace Center (DLR), the Research Center in Geesthacht (GKSS), the German Marine Research Consortium (KDM), the Leibniz Institute of Marine Sciences (IFM-GEOMAR), the United Nations University (UNU), the Gesellschaft für Technische Zusammenarbeit (GTZ), and the Federal Institute for Geosciences and Natural Resources (BGR), as well as Indonesian and international partners. The project is financed by the Federal Ministry of Education and Research (BMBF).

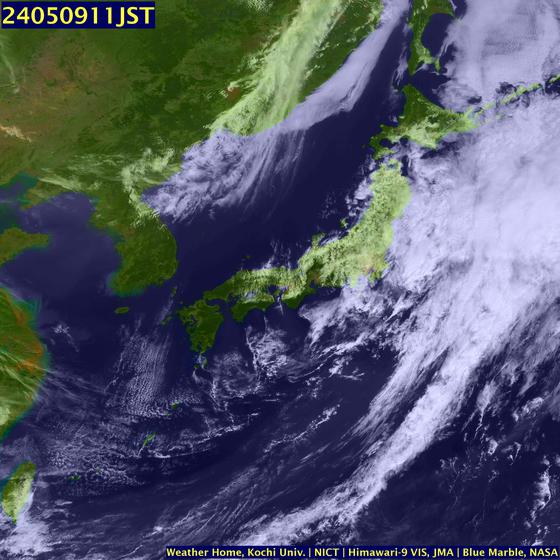

WEATHER NOTE

Twisters Hit Insurers With Worst Profit Dip Since '02 (Update3)By Erik Holm

July 17 (Bloomberg) -- Record tornado damages, the weakening economy and a drop in premiums may reduce insurers' earnings by 30 percent, the steepest second-quarter decline since 2002.

The industry's slump in profits is worse than all 24 groups in the Standard & Poor's 500 Index except for banks, financial- services firms and automobile companies, analysts surveyed by Bloomberg said. Sixteen of 20 insurers in the S&P 500, led by American International Group Inc. and Allstate Corp., may report lower net income or a loss.

Losses from catastrophes, including the most tornadoes in the U.S. since at least 1950, were about $5.5 billion. At the same time, investment returns and opportunities to sell residential and corporate coverage declined as the economy slowed and home sales dropped.

``We're going to see amazingly bad numbers from the property insurers in the second quarter,'' said Meyer Shields, an analyst at Stifel Nicolaus & Co. in Baltimore. ``There are lots and lots of losses out there.''

The estimated decline in profit, the most since earnings per share fell about 45 percent in 2002, may be driven by tornado losses at insurers such as Allstate, lower investment returns for companies like AIG and falling rates at commercial insurers including Travelers Cos., said Paul Newsome, an analyst at Sandler O'Neill & Partners in Chicago.

``You rarely get all three of those factors at once,'' Newsome said.

Allstate Corp.

Second-quarter results typically include fewer catastrophe costs than the third and fourth quarters, when the Atlantic hurricane season peaks, he said. Researchers at Colorado State University and AccuWeather.com predict an above average number of hurricanes will form this year, driven in part by higher ocean temperatures.

Allstate, the largest publicly traded U.S. home and auto insurer, may report profit of $1.35 a share, down 23 percent from a year earlier, according to the average estimate of 20 analysts surveyed by Bloomberg. The insurer, based in Northbrook, Illinois, will report results on July 23.

``I'm kind of crossing my fingers for Allstate,'' said Jim Ryan, an insurance analyst at Morningstar Inc. in Chicago. ``They haven't said anything to give us a hint about what their catastrophe losses might be.''

Costs Double

Hartford Financial Services Group Inc., the insurer based in the Connecticut city of the same name, said yesterday in an e- mailed statement that it had $171 million of costs from natural disasters in the second quarter. That compares to $177 million in all of 2007.

Cincinnati Financial Corp. and Harleysville Group Inc. of Harleysville, Pennsylvania, said catastrophe costs more than doubled in the quarter as an estimated 1,164 tornadoes struck the U.S., hitting towns from Colorado to Minnesota to Texas and killing 49 people, including four boys at an Iowa scout camp in June.

In last year's second quarter, industrywide catastrophe costs were 60 percent less, according to Insurance Services Office Inc. in Jersey City, New Jersey.

As the U.S. economy slowed in the second quarter, foreclosures reached new peaks. Insurers, including Allstate, drop coverage when policyholders lose their houses and also have fewer opportunities to attract new clients. New home sales will fall 26 percent this year to 573,000, New York-based Fitch Ratings estimated on July 11.

``This seems to be the worst housing market I've ever seen,'' said George Ruebenson, the president of Allstate's home and auto unit, in a May 29 interview. ``Our ability to expand the homeowners business for Allstate is severely limited by this economy.''

Underestimated

Expenses also may rise as the economy sours, said Bill King, senior executive vice president at State Farm Mutual Automobile Insurance Co., the No. 1 home insurer.

``The slowing of the economy could put people in more desperate financial situations that might cause a difference in claim behavior,'' King said.

When the economy slows, policyholders are more likely to reduce the amount of coverage they buy, resort to fraud or submit claims for smaller-than-usual losses, he said. State Farm of Bloomington, Illinois, is owned by its policyholders and has no publicly traded debt.

Analysts' estimates may understate the industry's decline in net income because their predictions don't account for the falling value of securities tied to home loans. Insurers have written down more than $77 billion of holdings since last year, including mortgage-backed assets, equity investments tied to the housing market and contracts that protect fixed-income investors, according to data compiled by Bloomberg.

Investment Losses

Insurers may lower the value of the assets further as they announce second-quarter results, said Shields of Stifel Nicolaus.

Investment losses helped push down stock prices, with every insurer in the S&P 500 Insurance Index declining this year except auto insurer Progressive Corp. and Seattle-based Safeco Corp., which agreed in April to be purchased by Liberty Mutual Group Inc. of Boston.

AIG, the world's largest insurer by assets, has written down more than $39 billion, higher than any other company in the insurance business, Bloomberg data show. The New York-based insurer has dropped about 57 percent this year.

Prices Fall

AIG and business insurers including Travelers of St. Paul, Minnesota, and Warren, New Jersey-based Chubb Corp. are charging less for commercial coverage in an attempt to win market share. Prices for such coverage fell 11 percent in the U.S. during June from a year earlier, according to MarketScout, the Dallas-based electronic insurance exchange. Prices have fallen for 40 consecutive months, MarketScout reported.

Rates will continue to fall and U.S. property and casualty insurers may pay more in claims and expenses than they collect in premiums by the time 2008 is over, Fitch Ratings said last month.

``You usually see large catastrophe losses in the third quarter when the hurricanes hit,'' said Morningstar's Ryan. ``I think it only gets worse from here.''

To contact the reporter on this story: Erik Holm in New York at eholm2@bloomberg.net.

MARITIME NOTE

FLEET OPERATOR: Ships are being inspected and crew members questioned.

By JAMES HALPIN

jhalpin@adn.com

(07/08/08 00:12:43) The number of mishaps aboard Cruise West vessels so far this season has landed the company on a special program to review the ships' safety and maintenance procedures, according to the U.S. Coast Guard.

Seattle-based Cruise West ships have so far suffered three mechanical failures and two groundings, including the most recent that took place Monday morning when the Spirit of Glacier Bay ran aground in Tarr Inlet near its namesake bay.

The Coast Guard began talking to the company about the trend after its ships suffered the second mechanical failure of the season, said Capt. Scott Robert, Coast Guard sector Juneau commander.

Mechanical problems are common on ships, and the Coast Guard in Alaska responds to hundreds of such calls each season, he said. But the number specifically on Cruise West ships this season prompted the extra attention, he said.

"After the third mechanical failure and the (first) grounding is when we started to take a very proactive approach on looking at the safety systems on board those vessels," Robert said. "These safety stand-downs are above and beyond what we, the Coast Guard, typically do with this industry."

The Coast Guard frequently holds surprise spot inspections and evaluates vessels at the beginning of the season, Robert said. The "safety stand-downs" are an added layer of oversight to promote safety and prevent serious accidents, he said.

As part of the plan, all of Cruise West's ships are being inspected by Coast Guard personnel, who are examining safety plans, equipment and maintenance policies, Robert said. The boardings also entail talking to crew members to improve their awareness of safety conditions, he said.

Cruise West officials are working in partnership, with its vice president "actively participating" in the stand-downs, Robert said. The boardings are scheduled in advance and take about two or three hours on average, he said. They are being held wherever the ships are -- in Alaska and elsewhere.

"This is a Coast Guard-wide issue," Robert said. "This is a combined, overarching look (at) Cruise West across the entire Coast Guard."

The agency plans to continue with the stand-downs until it is convinced Cruise West vessels are being operated and maintained safely, Robert said.

Jerrol Golden, spokeswoman for Cruise West, which operates nine small cruise ships, would not comment on the Coast Guard program, though she said safety is a top priority for the company. She stressed none of the incidents this season involved any injuries.

"Each incident is different, and there's definitely lessons learned immediately," she said. "There's no doubt the management system is under review by us, for sure."

She would not elaborate.

RS

![Validate my RSS feed [Valid RSS]](valid-rss.png)